35+ How to calculate mortgage borrowing

Defaulting on a mortgage typically results in the bank foreclosing on a home while not paying a car loan means that the lender can repossess the car. Applications for additional borrowing are subject to LTV and must meet our current lending requirements.

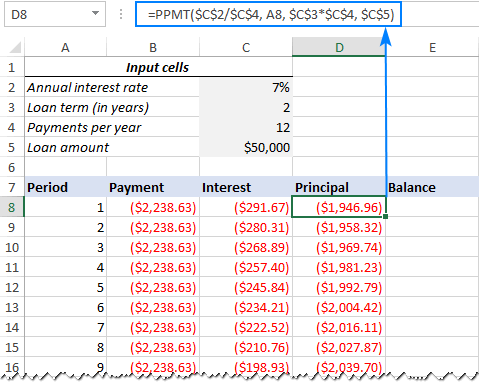

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

An adjustable-rate mortgage or ARM mortgage calculator could be a smart choice for those borrowers who are planning to repay the borrowing within a specific period or those who shall not be hurt financially when there is an adjustment in interest rate.

. Minimum term 3 years - maximum term 35 years maximum age 70 04. Please note this calculator is for educational purposes only and is not a denial or. Mortgages with longer terms have lower monthly repayments but youll pay more interest overall.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Ensure you request for assistant if you cant find the section. Well help you understand what it means for you.

Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. To use the VA loan calculator adjust the inputs to fit your unique homebuying or refinancing situation. If you saved a 50000 deposit for a 200000 home your loan amount would be 150000.

Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc. The calculator updates your estimated VA loan payment as you change the fields. To calculate your estimated DTI ratio simply enter your current income and payments.

Payments per year - defaults to 12 to. How to Calculate Mortgage Payments in Excel With Home Loan Amortization Schedule Extra Payments. The Latest from our Partners This Years Best High-Interest Savings Accounts.

Try this free feature-rich mortgage calculator today. Youre managing your debt adequately but you may want to consider lowering. Things to consider when borrowing more on your mortgage.

In most cases this phrase refers to after-tax cost of debt but it also refers to a companys cost of debt before. Lenders generally view a lower DTI as favorable. Includes your interest rate plus any loan fees.

Calculate your mortgage payment. Deposit calculator Mortgage calculator How much can you bid. Monthly Capital Interest Payment Breakdown.

A Simplified Guide to Borrowing Against Your Home Equity. The most common secured loans are mortgages and auto loans. This calculator figures monthly recreational vehicle loan payments.

Subprime mortgages grew from 5 of total originations 35 billion in 1994 to 20 600 billion in 2006. Additional borrowing is available on a capital and interest repayment. This has been a guide to the adjustable-rate mortgage calculator.

Cash-Out Refinance vs Home Equity Loan. Student loan interest rates represent the cost of borrowing money to pay. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees.

In the Advanced Settings section you can update the property taxes and insurance estimates for your specific location though 12 and 035 are typical. This is analogous to an individual. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level.

And that households would continue to make their mortgage payments. The Money Advice Service reckons borrowing 175000 at 3 interest over 35 years costs 34000 more than borrowing it over 25 years. Before sharing sensitive information make sure youre on a federal government site.

The second monthly payment budget calculator shows how expensive of a RV you can buy given a monthly. Get a better mortgage rate. If you have a residential mortgage with us in some circumstances you could borrow up to 90 of the value of your home.

The rate on the 30-year fixed mortgage increased to 581 this week from 578 last week according to Freddie Mac. Freddie Mac and the National Association of Homebuilders expect mortgage rates to be 3 in 2021 while the National Association of Realtors thinks it will reach 32 and Wells Fargo thinks rates will be 289. The Mortgage Bankers Asociations chief economist Mike Fratantoni believes the 30-year fixed rate will reach 33 in 2021 and 36 in 2022.

You most likely have money left over for saving or spending after youve paid your bills. It reflects the total cost of borrowing. To help you see current market conditions and find a local lender current current Redmond RV loan rates and personal loan rates personal loan rates are published below the calculator.

Borrowing at a lower interest rate and investing the proceeds at a higher interest rate is a form of financial leverage. 3599 APR and terms from 24 to 60 months. A lower mortgage rate will result in lower monthly payments increasing how much you can afford.

A good compromise could be to get a mortgage that has a longer term but allows you to make overpayments. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Minimum amount is 10000.

30 Year Mortgage Rates. Minimum term 3 years - maximum term 35 years maximum age 70. Which Is Best For You.

After filling out the order form you fill in the sign up details. It offers amortization charts extra payment options payment frequency adjustments and many other useful features. Looking Good - Relative to your income your debt is at a manageable level.

Shop around for the best mortgage rate you can find and consider using a mortgage broker to negotiate on your behalf. Cost of debt refers to the effective rate a company pays on its current debt. To calculate the.

In these examples the lender holds the deed or title which is a representation of ownership until the secured loan is fully paid. The gov means its official. Mortgage Learning Center Financing Your Dream Home Starts Here What To Know Before You Buy.

35 or even 40 years. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float calculator Credit card real cost Real. Federal government websites often end in gov or mil.

Calculate your mortgage payment. It will also save you thousands of dollars over the life of your mortgage. 375- 1335 with AutoPay.

Santander Loans Hot Sale 51 Off Www Wtashows Com

If I Take An Education Loan Amount Of Inr 20 Lakhs At An Interest Rate Of 8 9 For 7 Years What Will Be The Best Way To Repay The Loan Quora

Excel Ppmt Function With Formula Examples

If A Home Is Valued At 375 000 And Appraised At 355 000 And The Loan To Value Is 75 How Can I Calculate The Loan Amount Quora

Excel Ppmt Function With Formula Examples

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Is It Just As Easy To Pay For A House In Cash And Then Get A Mortgage Afterwards Quora

Your Adjustable Rate Mortgage Needs To Be Refinanced

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

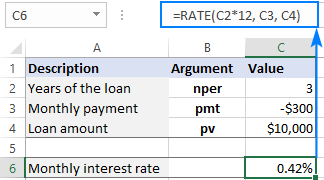

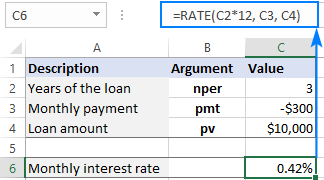

Using Rate Function In Excel To Calculate Interest Rate

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Your Adjustable Rate Mortgage Needs To Be Refinanced

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed